Managing material issues

MATERIAL ISSUES have been identified which could significantly impact positively or negatively on the group’s ability to create and sustain value.

Trading environment

Competition

Regulation

People

Information technology

The material issues are reviewed annually by the board and management where all relevant internal, industry and macroeconomic factors are evaluated. The needs, expectations and concerns of the stakeholder groups that are most likely to influence the group’s ability to create sustainable value, notably customers, suppliers, regulators, staff, shareholders and providers of financial capital are central to determining the material issues.

Following the review for the 2020 financial year, the directors confirm that the current material issues remain relevant and are unchanged from the previous year.

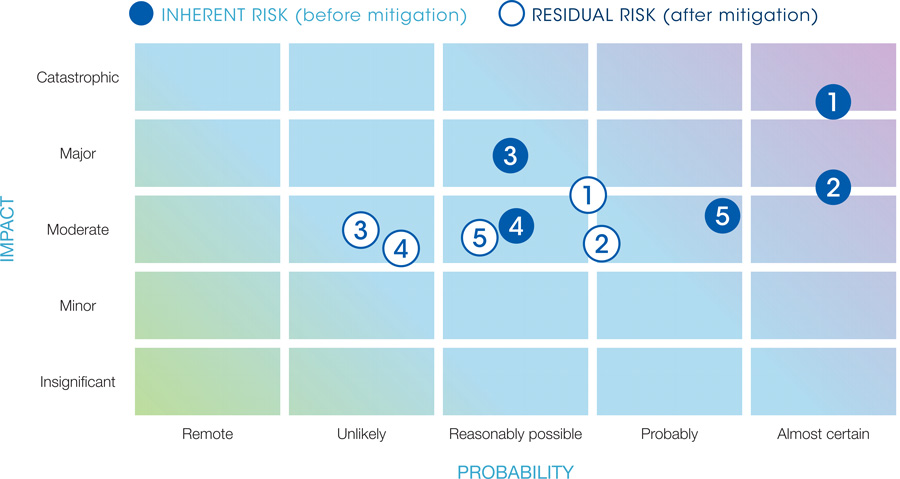

Risks relating to each material issue are based on the major risks on the group’s register. The accompanying risk heat map indicates the levels of risk before (inherent risk) and after (residual risk) mitigation plans have been implemented.

Opportunities are presented for each material issue to indicate how the group is using its competitive advantage to manage the impacts of the material issues on value creation.

Material risks

Trading environment

Low economic growth, poor economic conditions and the resultant weak consumer sentiment are impacting South Africa’s already constrained retail trading environment. Consumer disposable income has been further eroded by rising fuel and utility prices, higher health insurance costs and increasing general living costs.

Risks

- Economic environment remains challenging which is constraining consumer spending.

- Criminal activity, including syndicated crime, escalates during times of economic hardship.

- Currency volatility could impact on the cost of direct and indirect imports, and results in price increases which cannot be passed on to consumers.

- Increasing use of generic medicines and the added pressure of low single exit price (SEP) increases will continue to impact on UPD’s operating margin.

Opportunities

- Clicks will continue to pursue a strategy to improve price competitiveness, grow sales volumes and entrench the perception of Clicks as a value retailer.

- Focus on differentiators, including a convenient store and pharmacy network; private label and exclusive ranges; personalised engagement, leveraging the Clicks ClubCard loyalty programme and consistently high levels of customer care.

- UPD will continue to drive efficiencies to mitigate the impact of genericisation on the operating margin.

Competition

Clicks faces competition on several fronts, including national food retailers and general merchandise chains, and other pharmacy businesses.

Risks

- Expansion by corporate pharmacy and retail chains impacting on market share growth in Clicks

- Increasing price competitiveness and promotional activity of retailers, including competing loyalty schemes, could negatively affect sales and profitability in Clicks.

Opportunities

- Clicks has an extensive store network and plans to open 25 to 30 new stores each year, expanding to 900 stores in South Africa in the long term.

- Continued expansion of the pharmacy network with the long-term plan to open pharmacies in all Clicks stores in South Africa.

- Continued recruitment of new members to the Clicks ClubCard.

- Ongoing improvements in pricing, product offer and customer service.

People

Retail and healthcare skills are scarce and in high demand locally and internationally. Attracting and retaining talent is therefore critical to the group’s continued success. As the largest employer of pharmacy staff in the private sector in South Africa the group is actively building capacity to address the critical shortage of pharmacists.

Risks

- Inability to recruit, attract and retain talent for core business needs, including merchandise and planning, store management, information technology and pharmacy.

- Strike action causing disruption to operations, damage to property and financial loss.

Opportunities

- Salaries and incentives are externally benchmarked to ensure the group remains competitive.

- Bursary and internship programmes to attract pharmacy graduates.

- Retail graduate programme offered.

- Accredited training programmes for store management, key store roles, and merchandise and planning roles.

- Senior leadership development programme strengthens pool of management talent and provides candidates for succession planning.

- Group resourcing function established, including specialist pharmacy team.

Regulation

Healthcare markets are highly regulated across the world and approximately 50% of the group’s turnover is in regulated pharmaceutical products. The group supports regulation that advances the government’s healthcare agenda of making medicines more affordable and more accessible but opposes regulation which inhibits access to affordable healthcare and limits customer choice.

Risks

- Healthcare legislative and regulatory changes introduced by the Department of Health (DoH), SA Pharmacy Council (SAPC) and SA Health Products Regulatory Authority (SAHPRA) could impact on Clicks’ and UPD’s turnover and margins.

- Impacts include the ability to obtain pharmacy licences and to launch private label and exclusive scheduled and complementary medicines.

- Introduction of National Health Insurance (NHI) would impact on the private and public healthcare markets.

- Non-compliance with current and emerging legislation including the Companies Act, Consumer Protection Act, Protection of Personal Information Act, labour law and copyright legislation could result in monetary sanctions.

Opportunities

- Ensure Clicks and UPD are operating efficiently to maintain margins and profitability.

- Continue management engagement with the DoH, SAPC and SAHPRA on legislation and regulation.

- As the market leaders in retail pharmacy and pharmaceutical wholesaling, position Clicks and UPD to benefit from market consolidation arising from changes in legislation and regulation.

- Partner with government to be a preferred service provider to the NHI scheme.

Information technology

Real-time, uninterrupted IT systems are essential in today’s technology-driven business environment while robust IT security and governance processes are required to limit breaches of customer privacy and loss of data to avoid legal liability and reputational damage.

Risks

- Confidential customer or sensitive internal data compromised as a result of undetected data security breach or cyberattack.

- IT systems and architecture no longer appropriate in an environment of ever-increasing scale and requirement for real-time information.

- Inability to restore business operations and IT systems, including UPD automated picking system, in the event of a disaster.

- Power outages impacting the ability to trade and resulting in loss of sales.

Opportunities

- Improved information security practices and compliance as a result of increased online presence.

- Planned implementation roadmap for new IT systems with improved system efficiencies and cost savings that support the organic growth strategy.