UPD delivered double-digit sales and profit growth for the year, driven by good growth in the wholesale business. Reported turnover increased by 11.4% and UPD maintained its market-leading positions in both the pharmaceutical wholesale and bulk distribution markets.

The business benefited from the two increases granted in the regulated single exit price (SEP) of medicines in November 2016 (2.9%) and March 2017 (7.5%). The SEP increase in the previous year was 4.8%.

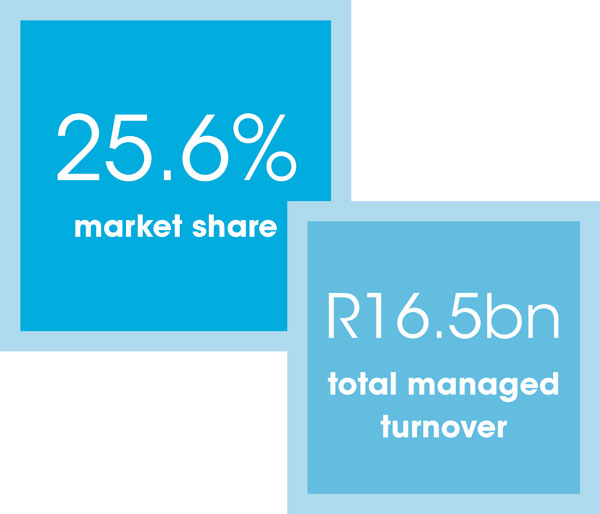

UPD’s total managed turnover, combining fine wholesaling turnover with the turnover managed on behalf of bulk distribution agency clients, increased by 8.8% to R16.5 billion.

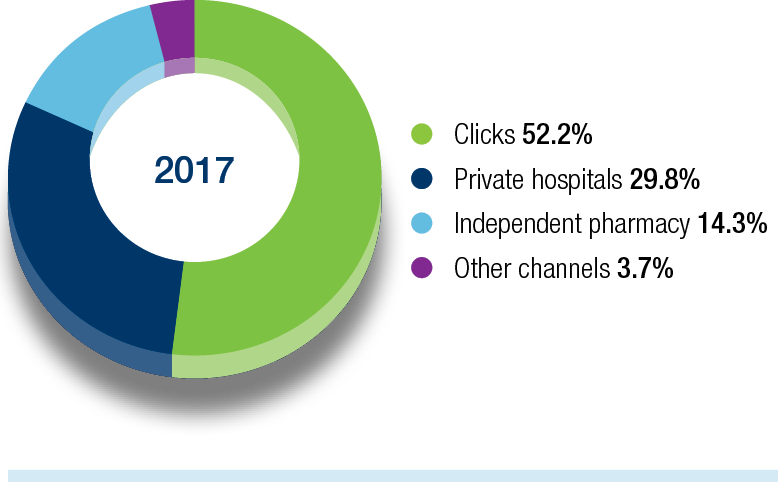

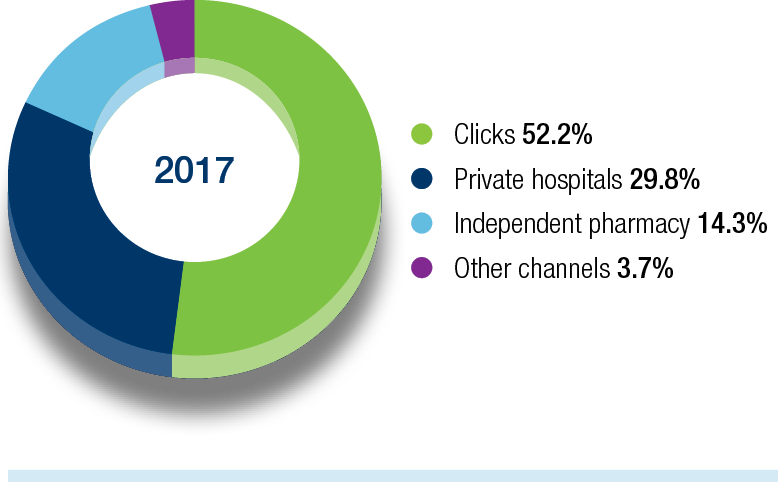

Wholesale turnover increased by 12.1% with strong growth of 23.4% in sales to Clicks pharmacies. Clicks remains UPD’s largest single customer and accounts for 52.2% of wholesale turnover.

Growth in sales to the private hospital groups, including Life Healthcare, Mediclinic and Netcare, was slower at 4.7%. This was partly due to sales to Medicross pharmacies moving from the hospital channel to the Clicks channel following the outsourcing agreement with the Netcare Group when Clicks took over the management of 37 Medicross pharmacies.

UPD services approximately 1 200 independent pharmacies and sales to this channel contracted by 2.6% and account for 14.3% of turnover.

UPD’s strong growth resulted in wholesale market share increasing from 24.1% to 25.6%.

The business continues to face ongoing margin pressure from the faster growth in lower-priced generics, which have increased from 47.2% to 49.1% of wholesale turnover.

Wholesale turnover by channel

As UPD has a high fixed cost base management is constantly seeking ways to off-set the margin pressure by increasing efficiency and scale of the business.

UPD owns its five distribution centres located in Gauteng (Lea Glen), Cape Town, Durban, Bloemfontein and Port Elizabeth. The new distribution centre in Port Elizabeth was completed early in the financial year at a cost of R27 million. The expansion of the Cape Town distribution centre commenced during the year and is scheduled for completion in December 2017.

Product availability, which is core to offering superior range and service to customers, was 95.2% and UPD increased on-time deliveries to 98.8% (2016: 98.5%).

Through its distribution business UPD offers local and international generic and originator pharma manufacturers an efficient and cost-effective supply chain solution. The business managed a portfolio of 20 distribution clients

at year-end.

Outlook for 2018

UPD aims to increase wholesale market share to 26% through the growth of the Clicks pharmacy channel, benefiting from the planned opening of 30 to 35 new pharmacies in Clicks, and maintain volumes from the private hospital groups.

Management plans to increase Clicks’ buying levels from UPD to 98.8% from the current 98.7%.

The annual SEP increase for 2018 is expected to be much lower than the increase granted in 2017.

Capital expenditure of R74 million has been committed for warehousing, IT and infrastructure, including the completion of the expansion of the Cape Town distribution facility.

Following the building of the new facility in Port Elizabeth, the expansion of the Cape Town warehouse and the planned reorganisation of the Johannesburg facility, bulk distribution warehouse capacity will be increased by approximately 30%. This will enable UPD to attract new distribution clients and grow business from existing clients.

In the current environment UPD will focus on further productivity initiatives across the business and maintaining its high levels of service to clients. This will enable the business to make progress towards achieving its long-term strategic objective of growing market share in both wholesale and bulk distribution to 30%.

Vikash Singh

Managing director

Performance against objectives in 2017 and plans for 2018

| Plans and targets for 2017 |

Achieved in 2017 |

Plans and targets for 2018 |

| Grow market share |

| Increase market share to 24.5% |

Market share increased to 25.6% |

Increase market share to 26% |

| Maintain volume of business with private hospital groups |

Sales to hospital groups increased 4.7% with volumes maintained |

Maintain volume of business with private hospital groups |

| Increase Clicks’ buying levels from UPD to 98.5% |

Clicks’ buying levels from UPD at 98.7% |

Increase Clicks’ buying levels from UPD to 98.8% |

| Tender for new agency distribution contracts |

One new agency distribution contract secured; 20 contracts managed at year-end |

Tender for new agency distribution contracts |

|

|

|

| Protect income |

| Maintain licences |

Licences maintained |

Maintain licences |

|

|

|

| Optimise efficiency |

| Target 98.5% on-time deliveries |

98.8% on-time deliveries |

Target 98.9% on-time deliveries |

| Reduce labour and transport costs |

Labour and transport costs as a percentage of turnover improved

96.1% order fulfilment

|

Drive further productivity initiatives across the business

Improve order fulfilment to 96.2%

|

| Build capacity |

| Target employee turnover of 14% |

Employee turnover 12% |

Maintain employee turnover at 12% or below |

| Extend cold chain capabilities |

Planning for implementation of temperature-controlled fleet

|

Temperature-controlled fleet to be rolled out

Establish UPD learning academy

|

Upd operating management

Vikash Singh (44)

Managing director

Joined the group in 2006

Previously head of operations and distribution at UPD, and prior to that was national finance and risk manager for logistics at Clicks

Finance and logistics experience

Julie Hulme (46)

Business process executive

Joined the group in 2015

Formerly quality assurance director (EMEA region) for Kimberly Clark Corporation

Experience in FMCG, engineering and manufacturing

Sanjeeth Baliraj (45)

Head of finance and procurement

Joined the group in 2011

Previously CFO and CIO for Imperial Car Rental/Europcar

Finance and commercial experience in multinational FMCG production and logistics

Palesa Seakamela (38)

Quality compliance manager

Joined the group in 2014

Previously quality and regulatory affairs manager at Afrox

Experience in quality and regulatory compliance in pharmaceutical manufacturing and distribution

Robert Magnus (48)

Sales and marketing executive

Joined the group in 2013

Previously national sales manager at Adcock Ingram Healthcare

Healthcare sales experience across both the private and public sectors

Leon Steyn (45)

General manager – Coastal

Joined the group in 2008

Previously branch manager at UPD Cape Town

Warehouse and distribution experience

JC Preller (42)

Distribution executive

Joined the group in 2015

Previously national sales manager at RAM Hand-to-Hand Couriers

Supply chain and logistics experience across multiple industries with strong commercial and operational background

Selven Naicker (43)

General manager – Inland

Joined the group in 2016

Previously distribution centre manager for UTI Pharma

Inventory and logistics experience

Chris Nursey (53)

Head of information technology

Joined the group in 2011

Previously senior manager (technology consulting) at Accenture

Experience in application development and the implementation of large IT solutions in the FMCG, banking and resources industries

Kelly Manzini (42)

National human resources manager

Joined the group in 2016

Previously chief executive officer for Careways and Life Occupational Health

Board member and director of the Employee Assistance Professionals Association SA since 2007

Downloads

Downloads

Shareholder Information

Shareholder Information