Creating value through good governance

Clicks Group recognises the value of corporate governance in ensuring the sustainability of the business and in enhancing long-term equity performance. While compliance with applicable regulation and voluntary codes is a good baseline from which to measure governance, and a non-negotiable demand by the board, the group’s commitment to good governance goes beyond compliance.

The group’s governance and compliance framework is founded on the principles of accountability, transparency, ethical management and fairness. Sound governance is entrenched across the entire business. Governance processes are regularly reviewed to align with regulatory changes and to reflect best practice.

The board believes that effective governance is also contributing to value creation in at least the following respects:

- providing a clearer view of the business through a greater degree of integration between financial and non-financial reporting;

- improving the quality of reporting by management to the board;

- promoting greater transparency and disclosure to stakeholders, including shareholders;

- building consumer confidence in the brands;

- enhancing accountability to shareholders;

- providing equitable performance management and reward structures for employees;

- providing effective leadership and decision-making throughout the business; and

- managing and mitigating risk more effectively.

Strong compliance structures and processes to support the effective functioning of these structures are essential to help avoid sanctions for non-compliance with regulation and to contribute to the sustainability of the business. The board accordingly maintains a focus on supporting and, where necessary, enhancing these structures and processes.

The group’s corporate governance report is published on the website.

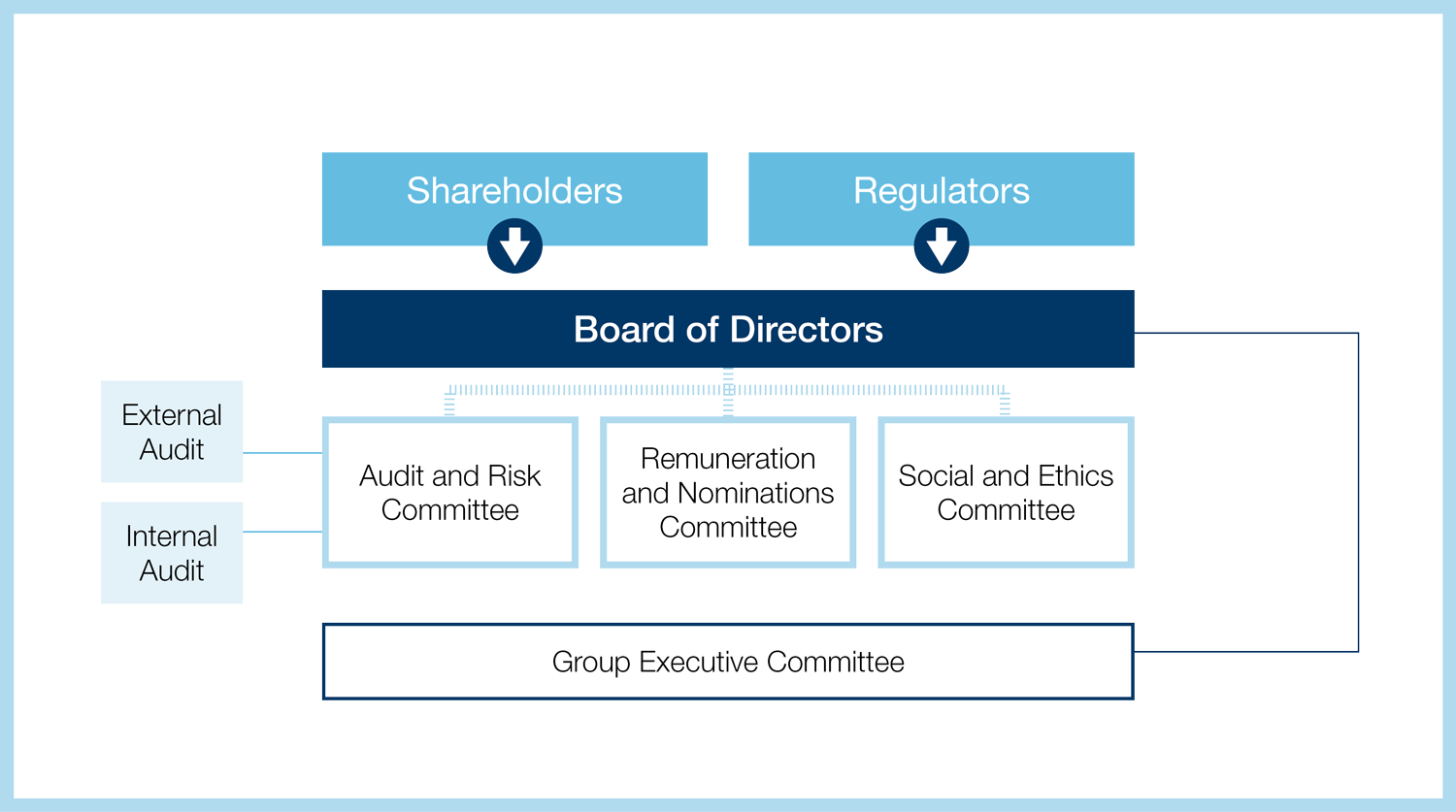

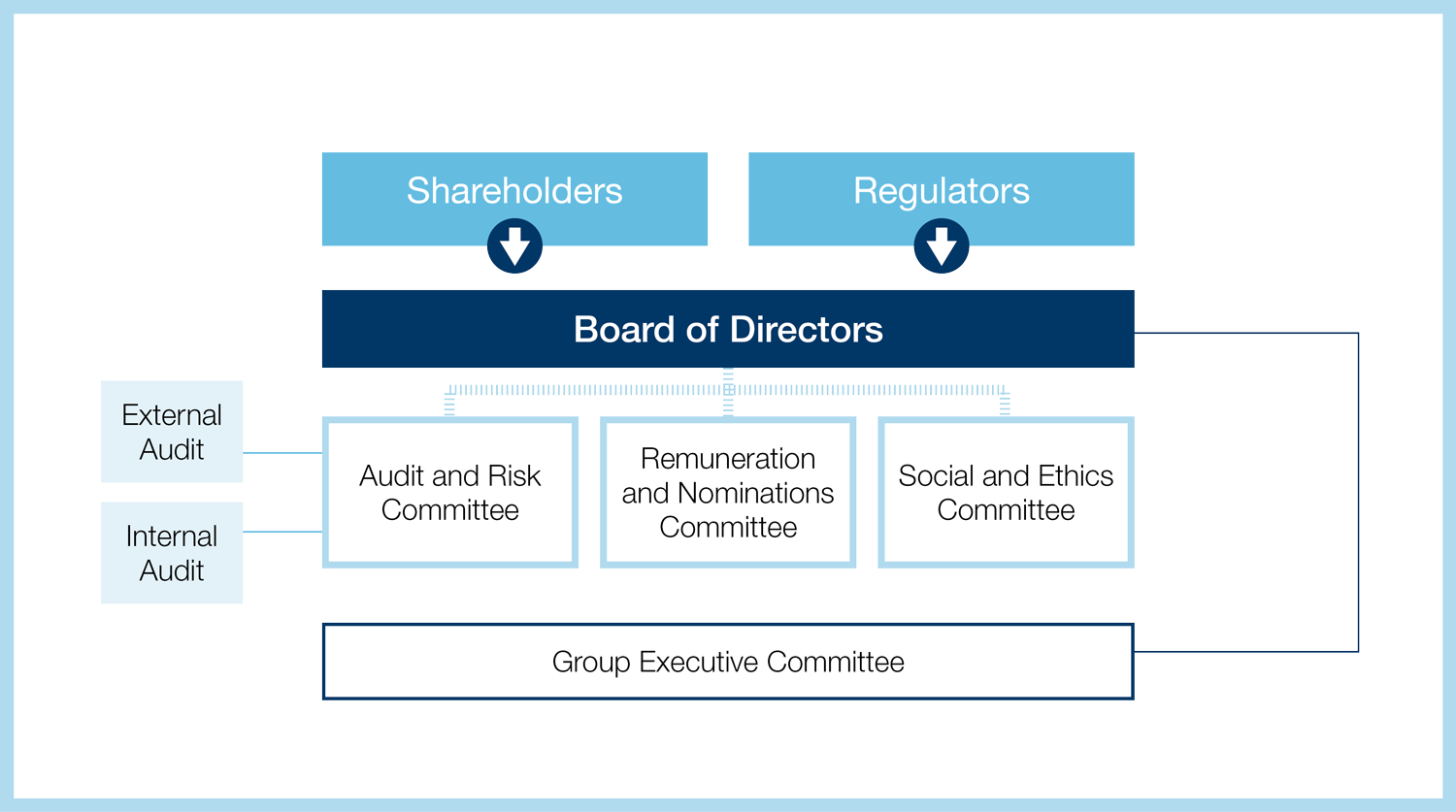

Governance structure

Role of the board

Elected by the shareholders, the directors are responsible for the sustainability of the business within the triple context of the economy, society and the environment. The board’s composition, authority, responsibilities and functioning are detailed in the board charter.

Its role includes fulfilling a range of legal duties, while being the primary source of effective, ethical leadership for the group. The board, in executing its mandate, is required to approve strategic plans; monitor operational performance; ensure effective risk management and internal controls; monitor regulatory compliance; and promote good governance. It must also approve significant accounting policies and the annual financial statements; monitor transformation and empowerment; manage the process of selection and appointment of directors; and ensure that the group’s remuneration policies and practices are effective and fair. Certain of these functions are delegated to board committees.

Key issues addressed in 2017

The board addressed the following key issues during the year:

- monitored the successful implementation of the long-term outsourcing agreement with Netcare, including regulatory matters such as Competition Tribunal approval and securing changes of ownership of pharmacy licences;

- approved the business’ three-year strategic plans and budgets, including capital investment;

- transitioned from King III to King IV;

- appointed a new director to the board and made changes to the composition of certain board committees;

- reviewed talent and succession plans for the business, including for the role of CEO;

- monitored preparation for the first vesting of shares to beneficiaries in terms of the employee share ownership programme;

- approved the investment in IT for operating divisions in the group; and

- supported management’s expansion of the group’s retailing activities in digital channels.

Board composition

The board consists of nine directors, with three salaried executive directors and six independent non-executive directors. The age, tenure, experience and expertise of each director is briefly set out in the board of directors report. Dr Nkaki Matlala retired as a non-executive director on 26 January 2017 and Nonkululeko Gobodo was appointed as a non-executive director on 1 March 2017.

Independence of directors

While the tenure of non-executive directors is not a determinant of independence for both King lll and King lV, David Nurek has served as a non-executive director for 21 years, Martin Rosen for 11 years and Fatima Abrahams, John Bester and Fatima Jakoet have each served for nine years. The company derives extensive benefit from the depth of knowledge of the business and the consistent approach to the strategy that long-serving directors bring, and will appoint strong, suitably qualified new independent non-executive directors from time to time to ensure that independent, fresh and critical thinking is maintained at board level.

The remuneration and nominations committee conducted an evaluation of the independence of the chairman and non-executive directors during the year. Factors which could impact on their independence and performance were considered, in particular the factors contained in King III and the JSE Listings Requirements. In the opinion of the remuneration and nominations committee there are no factors which prevent the directors from exercising independent judgement or acting in an independent manner. All of the non-executive directors, including the chairman, are therefore appropriately classified as being independent.

The company has no controlling shareholder or group of shareholders and there is no direct shareholder representation on the board.

Board diversity

The directors are diverse in terms of gender, race and professional backgrounds, contributing to strong decision-making and ensuring that a range of perspectives are brought to bear on matters under consideration by the board. The directors have extensive experience and specialist skills across a range of sectors, including retail, commercial, governance, human resources, remuneration, accounting and finance, legal, healthcare and marketing. A board race and gender diversity policy was adopted during the year. Currently 44% of the directors are female and 44% are black, which exceeds the voluntary targets of 25%.

Director election

A third of non-executive directors are required to resign at each AGM, and executive directors are required to resign on the third anniversary of their appointment or most recent re-election to the board. This provides shareholders with the ability to hold directors to account and to appoint directors to the board whom shareholders believe will add value to the business.

Annual performance evaluation

Directors are required to annually assess the performance of the board, its committees, the chairman and the chief executive officer. This year’s assessment indicated that in the opinion of the directors the board, its committees and the company’s most senior executives have discharged their responsibilities effectively. The directors believe that the board is well balanced in terms of skills, qualifications and experience and makes a meaningful contribution to the group.

Board and executive relationship

The roles of the chairman and the chief executive officer are formalised, separate and clearly defined. This division of responsibilities at the helm of the company ensures a balance of authority and power, with no individual having unrestricted decision-making powers. The chairman, David Nurek, leads the board and the chief executive officer, David Kneale, is responsible for the executive management of the group.

While the board and executive management collectively determine the strategic objectives of the group, the board is responsible for approving the group’s strategy and the executive is responsible for executing this strategy and for the ongoing management of the business. Regular reporting by the executive on progress made in executing its mandate allows the board to monitor implementation of strategy and to assess the effectiveness thereof. Non-executive directors have direct access to management and may meet with management independently of the executive directors.

Board and committee meeting attendance

|

Board |

Audit

and risk |

Remuneration

and

nominations |

Social

and

ethics |

| Number of meetings |

4 |

4 |

3 |

2 |

| David Nurek |

4+ |

1 (1)# |

3^ |

2+ |

| Fatima Abrahams |

3 |

|

3^^+ |

2 |

| John Bester |

4 |

4+ |

3 |

|

| Bertina Engelbrecht |

4 |

(4) |

(3) |

2++ |

| Michael Fleming |

4 |

(4) |

|

|

| Nonkululeko Gobodo* |

2/2 |

2/2 |

|

|

| Fatima Jakoet |

4 |

4 |

|

|

| David Kneale |

4 |

(4) |

(3) |

2 |

| Nkaki Matlala** |

1/1 |

1/1 |

|

|

| Martin Rosen |

4 |

|

3 |

|

| Meeting attendance 2017 (%) |

97 |

100 |

100 |

100 |

| Meeting attendance 2016 (%) |

97 |

100 |

92 |

100 |

Board oversight

The board discharges its oversight function both directly and through its three committees. The board and the three committees are each chaired by independent non-executive directors. The composition of the committees conformed to regulatory requirements and King III for the reporting period. With the introduction of King IV the composition of the social and ethics committee has been amended to meet the requirements of the code. Detailed disclosure on the roles, functions and composition of the committee is contained in the corporate governance report available on the website.

King iii and king iv application

The group has applied King III during 2017. King IV is effective for the 2018 financial year. Certain elements of King IV have already been adopted by the group and reporting for the 2017 financial year is in accordance with King IV.

Ethics and values

The group subscribes to high ethical standards of business practice. A set of values and a behavioural code of conduct require staff to display integrity, mutual respect and openness. Members of staff have an obligation to challenge others who are not adhering to these values. The social and ethics committee is responsible for monitoring ethical practices. The group has various documented policies which require all employees to adhere to ethical business practices in their relationships with one another, suppliers, intermediaries, shareholders and investors. These policies also set stringent standards relating to the acceptance of gifts from third parties and declarations of potential conflicts of interests. A fraud prevention policy ensures that a firm stance is taken against fraud and the prosecution of offenders.

Anti-competitive conduct

Oversight, governance and risk management processes are in place to promote compliance with statutory prescripts relating to competition and the effectiveness of these processes is borne out by the fact that the group has not been sanctioned for anti-competitive conduct. The group has market-leading positions in healthcare retailing and supply. This emphasises the need for the group to remain vigilant in guarding against engaging in anti-competitive practices.

Governance focus areas in 2018

In the year ahead the group will be engaged with the transition from King III to King IV, as well as ensuring that incremental changes to the JSE Listings Requirements and changes required by any new regulation are incorporated into the governance system. The group will remain abreast of regulatory changes that impact on governance in the organisation and will strive to adopt relevant best practices.

Downloads

Downloads

Shareholder Information

Shareholder Information