Clicks produced another strong trading performance, led by pharmacy and front shop health sales. Customers continued to respond positively to the Clicks value promotions and differentiated product ranges as the chain reported strong volume growth while gaining market share in all product categories.

Health and

beauty sales* |

%

increase |

%

contribution

to sales |

| Pharmacy |

25.7 |

29.9 |

| Front shop health |

13.7 |

22.9 |

| Beauty and personal care |

9.5 |

31.6 |

| General merchandise |

8.4 |

15.6 |

| Total turnover |

14.7 |

100.0 |

|

|

|

Sales performance

Pharmacy sales grew by 25.7% and contributed to Clicks increasing its retail pharmacy market share from 19.7% to 22.2%. The pharmacy category benefited from the opening of 73 pharmacies, including 37 as part of the outsourcing agreement with the Netcare Group.

Generic medicines continued to grow faster as more patients are being switched to these lower-priced alternatives, with sales increasing by 30.4% and accounting for 49.8% (2016: 47.7%) of pharmacy sales in Clicks.

Over-the-counter medicines, which do not require a prescription, continued to grow stongly, confirming the trend to self-medication where customers take responsibility for their own health and wellness.

Front shop sales continue to be driven by promotional sales which increased by 24.1% and accounted for 34.7% of sales in Clicks.

Front shop health grew sales by 13.7%, with GNC lifting sales by 21.9% and baby 19.2%. Baby merchandise is strategically important in attracting new customers and continues to be the fastest-growing front shop category in Clicks. Market share in the baby category increased from 12.2% to 13.9%.

Beauty and personal care sales grew by 9.5% with good performances from the Claire’s brand, fragrances and toiletries. Growth in haircare was slower owing to a lack of product innovation although Clicks continued to grow its share of the market from 25.7% to 27.2%.

General merchandise, which has the most discretionary product offering, grew sales by 8.4%, led by the convenience categories which grew by over 20%. Clicks maintained its leading position in small electrical appliances with a market share of 20.0%.

| Market share (%) |

2017 |

2016 |

| Health |

|

|

| Retail pharmacy* |

22.2 |

19.7 |

| Front shop health** |

29.7 |

29.0 |

| Baby** |

13.9 |

12.2 |

| Beauty and personal care |

|

|

| Skincare** |

28.3 |

27.3 |

| Haircare** |

27.2 |

25.7 |

| General merchandise |

|

|

| Small household appliances*** |

20.0 |

19.2 |

Expanding store footprint

Clicks passed the 600-store mark as 111 net new stores were opened, increasing the brand’s footprint to 622 stores at year-end. The growth in the store footprint was accelerated through the implementation of a long-term outsourcing arrangement with the Netcare Group whereby Clicks has opened stores in 43 Netcare hospitals and taken over the management of the pharmacies in 37 Medicross medical and dental centres.

The Clicks footprint includes 28 stores in neighbouring Namibia (19 stores), Swaziland (four stores), Botswana (four stores) and Lesotho (one store).

During the year 55 stores across the chain were extended or refurbished to ensure the stores remain modern and appealing to customers.

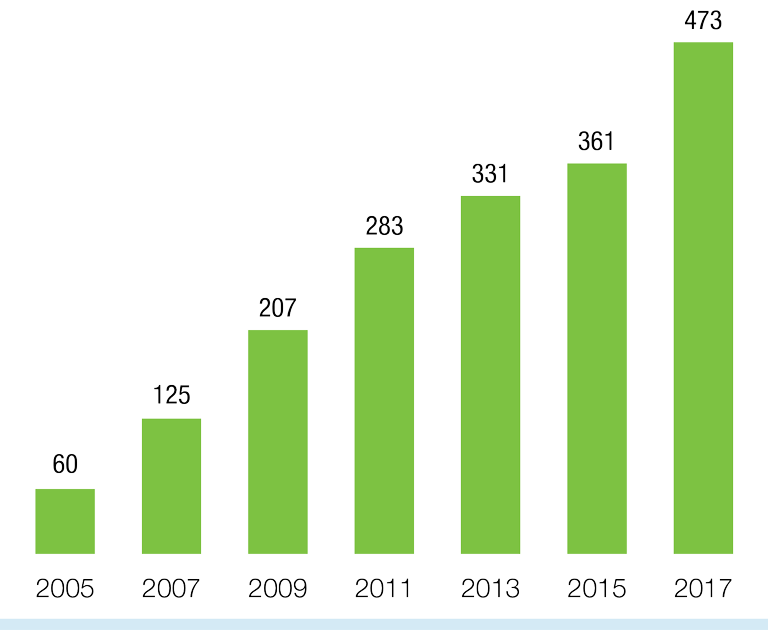

Clicks is the largest retail pharmacy chain in the country and extended its network to 473 with the opening of 73 in-store pharmacies. Clicks was ranked first in the pharmacy category in the annual Ask Afrika Orange Index service excellence survey.

Customers have responded positively to the Clicks online offer which was launched late in the last financial year, offering the product range available in large Clicks stores. The online platform complements the store experience and increases customer convenience, with a “click and collect” delivery facility in most Clicks stores in South Africa. The online store has shown good growth and in the short term is expected to generate sales equivalent to a small Clicks store.

Customer loyalty and engagement

ClubCard is a strategic growth driver which builds loyalty to the brand, increases the frequency of shopping and enables Clicks to engage digitally with its customers.

Active membership reached the 7 million mark during the year. ClubCard members accounted for 77.4% of sales in Clicks and R322 million was returned to customers in cashback vouchers.

Clicks extended its digital offering with the launch of the Clicks mobile app which includes a virtual ClubCard, eliminating the need for customers to use the traditional plastic card. The app also allows customers to submit scripts and order repeat medication.

ClubCard benefits were further extended through an affinity partnership with Shell South Africa which allows members to earn ClubCard points when filling up at Shell fuel stations nationwide.

Differentiated product offer

Private label and exclusive brands increase the appeal of the Clicks brand, offer differentiated ranges at competitive prices and are also margin enhancing. Sales of private label products accounted for 21.8% of total sales in Clicks, with front shop sales at 28.5% and pharmacy at 6.1%.

The best-selling ranges of the group’s exclusive health and beauty franchise brands, The Body Shop, GNC and Claire’s, further differentiate the Clicks offer. The Body Shop has a presence in 122 Clicks stores, GNC in 375 stores and Claire’s in 142 Clicks stores. Clicks is also the exclusive retail stockist of the Sorbet product range.

Motivated and skilled people

A key element of improving the in-store experience for customers is the service levels from knowledgeable and friendly staff. The group is committed to investing in its people, evidenced by the R106 million investment in training and development in the past year.

As the largest employer of pharmacy staff in the private sector with over 2 700 pharmacy and clinic professionals, Clicks is actively building capacity through the Pharmacy Healthcare Academy and providing financial support to address the critical shortage of pharmacists.

Clicks awarded 100 bursaries to pharmacy students in 2017 and has invested over R22 million in bursaries in the past five years. During the year 339 pharmacy assistants were enrolled and 64 pharmacy internships awarded.

The store operations learnership programme attracted 100 trainee managers in 2017 while 20 graduates were enrolled on the retail graduate development programme.

Outlook for 2018

Clicks has a long-term goal to expand its store footprint to 900 in South Africa. In the year ahead Clicks plans to open 25 to 30 new stores and 30 to 35 new pharmacies. A further 55 stores will be refurbished.

The Clicks distribution centre in Centurion, Gauteng, is being expanded by 20 000 m² to support the increasing scale of the Clicks chain. The project will be undertaken at a cost of R230 million and is expected to be completed during the first quarter of financial year 2019.

Private label, together with exclusive and franchise brands, is planned to contribute 29% of front shop sales in the new year. The presence of The Body Shop, GNC and Claire’s will be expanded to additional Clicks stores in the year ahead.

ClubCard membership is targeted to grow to 7.5 million while we plan to enrol at least 100 000 customers to the new virtual ClubCard.

Vikesh Ramsunder

Chief operating officer

Performance against objectives in 2017 and plans for 2018

| Plans and targets for 2017 |

Achieved in 2017 |

Plans and targets for 2018 |

| Deliver a competitive and differentiated product offer |

| Increase front shop private label and exclusive brand sales to 28.0% |

Front shop private label and exclusive sales 28.5% (2016: 28.2%) of total sales |

Increase front shop private label and exclusive brand sales to 29% |

Expand presence of franchise brands in Clicks

- The Body Shop: 103 stores

- GNC: 300 stores

- Claire’s: 150 stores

|

Franchise brands in Clicks stores

- The Body Shop: 122 stores (2016: 88)

- GNC: 375 stores (2016: 261)

- Claire’s: 142 stores (2016: 123)

|

Expand presence of franchise brands in Clicks

- The Body Shop: 150 stores

- GNC: 390 stores

- Claire’s: 150 stores

|

| Create a great customer experience in-store |

| Expand private label scheduled generic medicines range by 32 products |

100 private label medicines (2016: 100) |

Expand private label scheduled generic medicines range |

| Grow repeat prescription service to 50% of repeat scripts |

43% of scripts now on repeat prescription service |

Increase repeat prescription service to 50% of repeat scripts |

| Expand clinic services and open 10 new clinics |

195 clinics at year-end |

200 clinics |

| Grow the retail footprint |

| Open 20 to 25 new Clicks stores |

Net 111 stores opened (2016: 25)

622 stores at year-end (2016: 511)

|

Open 25 to 30 new Clicks stores |

| 60 stores to be expanded/refurbished |

55 stores expanded/refurbished (2016: 45) |

55 stores to be expanded/refurbished |

| Open 30 to 35 new pharmacies |

Net 73 pharmacies opened (2016: 39)

473 pharmacies at year-end (2016: 400)

Launched in-store collection service

|

Open 30 to 35 new pharmacies |

| Drive customer loyalty through ClubCard |

| Increase membership to 6.5 million |

7.0 million members (2016: 6.2 million) |

Increase membership to 7.5 million |

| Grow Baby Club to 400 000 members |

417 000 Baby Club members |

Grow Baby Club to 520 000 |

| Grow Seniors Club to 800 000 members |

839 000 Seniors Club members

Launched Clicks mobile app

Launched virtual ClubCard

Launched affinity partnership with Shell

|

Grow Seniors Club to 900 000

Enhance digital engagement

Enrol 100 000 customers to virtual ClubCard

|

| Ensure supply chain excellence |

| A new strategic objective not included in 2016 |

n/a |

Complete Centurion distribution centre expansion |

| Motivated and effectively skilled staff |

| 300 pharmacy assistants to be enrolled |

339 pharmacy assistants enrolled |

300 pharmacy assistants to be enrolled |

| 100 pharmacy bursary students |

100 pharmacy bursary students |

100 pharmacy bursary students |

| 90 internships |

64 pharmacy internships

20 graduates enrolled on graduate development programme

|

70 internships

20 graduates to be enrolled on graduate development programme

|

Clicks executive management

Vikesh Ramsunder (46)

Chief operating officer

Joined the group in 1993

Previously managing director of UPD and prior to that was head of logistics at Clicks

Extensive retail, distribution and logistics experience

Jacques de Kock (47)

Head of supply chain

Joined the group in 2010

Formerly group head of IT and before that worked for the Ikano Group in Europe

Over 15 years’ international retail and FMCG experience in large supply chain and IT organisations

Gordon Traill (46)

Head of finance

Joined the group in 2006

Previously head of group finance and head of internal audit

Prior to this held various financial positions with Alliance Boots in the UK

Rachel Wrigglesworth (52)

Head of healthcare

Joined the group in 2011

Previously commercial head at UPD

Pharmaceutical manufacturing, hospitals, pharmacy and commercial healthcare experience

Sedick Arendse (47)

Head of stores

Joined the group in 2015

Previously chief sales and operations officer at Nashua

Extensive experience in retail operations, supply chain, brand development and management consulting

Nandipha Ngumbela (42)

Human resources executive

Joined the group in 2015

Previously HR director at Chevron SA

Experience in human resources management, employee relations, organisation development, transformation and talent management

Jamie Lane (36)

Head of merchandise and marketing

Joined the group in 2012

Previously commercial executive for Clicks Front Shop (excluding health)

Prior to joining the group he was commercial director of L’Oréal Paris for the UK and Ireland

Chris Tugman (49)

Group head of information technology

Joined the group in 2016

Previously IT director at Massbuild, a division of Massmart

Experienced in IT systems implementations and management in retail and FMCG

Downloads

Downloads

Shareholder Information

Shareholder Information