Chief Executive's report

Strong and resilient trading performance

Clicks delivered another strong trading performance in tough retail conditions, reporting good volume growth and increased market shares in all product categories. The brand continues to demonstrate its resilience in the current constrained spending environment, with healthcare being a necessity and beauty an affordable luxury.

Customers continue to make Clicks their first choice health and beauty retailer, responding positively to the brand’s value promotions and differentiated product ranges. Retail health and beauty sales, including Clicks and the franchise brands of The Body Shop, GNC and Claire’s, increased by 14.7%, led by pharmacy and front shop health.

In pharmacy Clicks is actively switching customers to lower-priced generic medicines to enable medical aid benefits to last longer. Generic medicine sales have grown by 30.4% and now make up almost 50% of pharmacy sales in Clicks.

Front shop sales are being driven by promotional sales which now account for 34.7% of turnover and this is supporting Clicks’ value positioning where the brand is price competitive with all other national retailers.

Strong sales growth and the expansion of the pharmacy footprint has seen Clicks increase its share of the retail pharmacy market to 22.2%.

Front shop health market share increased to 29.7%, with the baby category growing to 13.9%. In the beauty category, skincare market share grew to 28.3% and haircare to 27.2%.

Clicks has again been voted as the country’s leading health and beauty retailer and leading pharmacy chain, in the authoritative The Times/Sowetan annual shopper survey for 2017.

The structural changes in the music market with the move to streaming and downloading, together with a weak release schedule, contributed to Musica’s sales declining by 7% on last year. Musica continues to gain market share and now has over 77% of the country’s music market and close to 60% of the movie market. Shareholders should note that all Musica’s 113 stores are profitable and the business continues to generate cash. Management aims to further derisk Musica by moving to consignment stock with suppliers, a business model successfully employed by leading music retailers in the UK and Europe.

UPD, the group’s pharmaceutical distributor, increased wholesale turnover by 12.1%, with market share increasing to 25.6%. UPD benefited from the growth from Clicks and the private hospital groups, and the higher increase in the single exit price (SEP) of medicines in the past year.

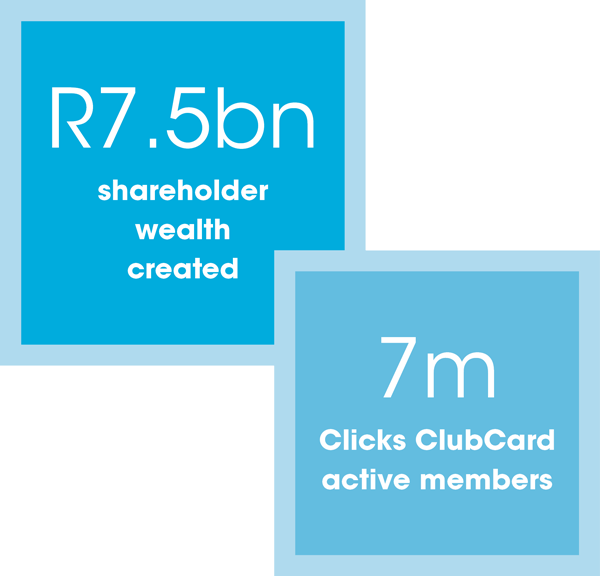

The performances outlined above contributed to group turnover growing by 10.9% to R26.8 billion. The financial performance is outlined in the chief financial officer’s report and the Five-year performance review, and the trading performance is covered in Clicks and UPD.

Delivering on our strategy

The group is committed to its strategy of creating sustainable long-term shareholder value through a retail-led health, beauty and wellness offering (refer to group strategy). The strategic objectives for Clicks and UPD to deliver the group’s strategy are reviewed annually to ensure they remain appropriate for the prevailing economic and trading environment, and to continue meeting the ever-changing needs of customers.

We believe excellent progress has been made over the past year in delivering on these strategic objectives.

Clicks opened a record 111 new stores to expand the footprint to 622. A long-term outsourcing agreement concluded with the Netcare Group during the year accounted for 80 of the new stores, with Clicks taking over the management of the pharmacies in 37 Medicross medical and dental centres and opening stores in 43 Netcare hospitals.

The chain has 28 stores in neighbouring Botswana, Lesotho, Namibia and Swaziland.

Clicks remains the largest retail pharmacy chain in the country and expanded the network to 473 as a net 73 pharmacies were opened. While the difference between the number of pharmacies and the total number of stores still appears to be large, there are currently only 57 Clicks stores in South Africa that are missing a pharmacy, excluding the stores where we do not plan to open a pharmacy. This includes non-South African stores, the Netcare hospitals and stores which have been identified to be closed.

Private label and exclusive brands ensure Clicks provides a differentiated product offer to customers. Sales of private label products accounted for 21.8% of total sales in Clicks, with front shop sales at 28.5% and pharmacy 6.1%. Based on volume sales, one in three of every front shop product sold is only available in Clicks.

ClubCard reached the milestone of 7 million active members and has been independently rated as South Africa’s most popular and easiest to use retail loyalty programme. Customers received over R320 million in cashback this year, with over R1.4 billion being paid out in cashback over the past five years.

ClubCard is integral to our digital strategy which aims to complement the store experience and enables us to better understand and engage with customers.

The online shopping platform has been well received, supported by “click and collect” in stores and home delivery, and in the new financial year we plan to extend the product offer with online only ranges.

UPD provides an efficient healthcare supply chain for Clicks. Total managed turnover has grown to R16.5 billion, highlighting the success of the strategy of developing the bulk distribution business alongside UPD’s traditional fine wholesaling business. UPD manages a portfolio of 20 distribution clients which accounts for almost half of total managed turnover.

Record investment for growth

Over the past year record levels of capital expenditure of R518 million have been invested to support the group’s long-term growth aspirations. This included over R340 million for new retail stores and refurbishments to maintain the quality of the store portfolio, R146 million for IT and retail infrastructure, and R30 million for UPD warehousing and infrastructure.

Another year of record investment of R680 million is planned for 2018, including R300 million on new stores, pharmacies and refurbishments. The refurbishment programme ensures that stores remain modern and appealing to customers, and that trading densities are maximised.

The Clicks distribution centre in Centurion, Gauteng, is being expanded at a cost of R230 million over the next two financial years. The investment in warehousing, IT and infrastructure in UPD has been increased to over R70 million, which includes the expansion of bulk distribution capacity at UPD’s Cape Town warehouse.

Our extensive store network and highly integrated supply chain provide competitive advantages which we aim to maintain by investing close to R2 billion over the next three years.

Investing in our people

Attracting and retaining scarce retail and healthcare skills is critical to the group’s sustainability. In the past year R126 million was invested in training over 5 600 employees while more than 600 new jobs were created in the retail business.

The broad-based employee share ownership plan introduced in 2011 is a mechanism to retain talent as well as accelerate transformation. Through the scheme 5 882 employees are now shareholders in the Clicks Group and are sharing in the long-term growth and success of the business. Black staff account for 88% of the employee shareholders and female employees 66%. Dividends of R28.2 million have to date been paid to participants in the scheme.

Clicks continues to build capacity to assist in addressing the severe shortage of pharmacists in the country. In the past year Clicks invested R4.4 million in bursaries for 100 pharmacy students, provided 64 pharmacy internships and trained over 300 learners through the in-house Pharmacy Healthcare Academy for pharmacy assistants.

Further detail is contained in the creating value through good citizenship report.

Regulatory engagement

Pharmacy agenda

Clicks Group supports regulation which advances government’s healthcare policy of increasing access to affordable medicine. We continue to engage constructively with the Department of Health (DoH) and believe our pharmacy agenda will further government’s aims as the country moves towards implementing National Health Insurance.

Our position is as follows:

-

Promote pharmacy as the primary source for basic healthcare needs.

This will require the broadening of the scope of practice to empower pharmacists to prescribe medicines above schedule 2 for common conditions.

-

Increase access to affordable medicines

This could be achieved by schedule 1 and 2 medicines being exempted from the SEP regulations to allow for more competitive pricing and discounting; adopting a more liberal scheduling regime in South Africa in line with international norms; and removing the restrictions on the marketing of schedule 1 and 2 medicines.

Regulation of health supplements

The most restrictive regulatory issue facing the group currently is the regulation of health supplements as a subset of complementary medicines under the Medicines Act. This requires all health supplements to be registered through the SA Health Products Regulatory Agency (SAHPRA) (formerly the Medicines Control Council (MCC)).

We strongly believe that health supplements should be regulated under food law as they are not medicines as defined by the Medicines Act.

This regulation is stifling innovation and limiting customer choice, and is directly impacting on GNC’s ability to broaden its product offer with new lines.

We continue to work in conjunction with the Health Products Association to lobby for change in the regulations and are hopeful that the transition from the MCC to SAHPRA will bring about this change. However, should our engagement not yield the desired results we are prepared to challenge the regulations in court.

Growth opportunities and outlook

The directors and management are optimistic about the prospects for the medium to long term, supported by the strong organic growth opportunity in Clicks which underpins the group’s investment case.

In the external environment, the market dynamics are favourable for the retail sector and, more specifically, for the health and beauty markets in which we operate. Increasing urbanisation, improving living standards and longer life expectancy will create a growing market for our health and beauty products. At the same time South Africa’s middle income market, which is our core customer base, is showing steady growth.

Clicks can grow its store and pharmacy footprint to make the chain even more convenient. Our research indicates that only about 50% of South African households live within five kilometres of a Clicks store and our long-term goal is to expand the chain to 900 stores in South Africa, with a pharmacy operating in every store.

Clicks has a differentiated product offer with a strong and trusted private label brand complemented by exclusive local and international brands.

Customer loyalty can be leveraged through our extensive ClubCard membership base and increasingly through digital engagement with our customers, from the online transaction website to the Clicks mobile app, virtual ClubCard and interactive communication across a range of social media and other digital channels.

A further driver of long-term growth is the opportunity to add scale to UPD’s business, particularly in bulk distribution.

However, in the year ahead the retail sector will face headwinds from low economic growth and political uncertainty which are expected to continue to dampen consumer confidence and constrain spending.

Internal selling price inflation is likely to decline to low single-digit levels, with the annual SEP increase likely to be much lower than it was in 2017.

The core health and beauty markets in which we trade are defensive and have proven to be relatively resilient in challenging trading conditions. We have shown our ability to trade our way through these tough conditions and believe our market-leading brands are well positioned in this environment.

We are therefore continuing to invest for growth in new stores, pharmacies and refurbishments, as well as significant investment in the retail and pharmaceutical supply chain to support the increased scale of the group. We are also committed to investing in our people to ensure that growth is sustainable.

The directors believe that the group’s strategy remains appropriate to provide continued competitive advantage in the current trading environment, and are confident in the group’s ability to sustain performance and deliver on our targets.

Appreciation

Thank you to our chairman, David Nurek, for his decisive leadership of the board and to our non-executive directors for their ongoing support and guidance.

The success of the past year can be ascribed to a true team effort by over 14 600 people and I extend my gratitude to my group executive colleagues Michael Fleming, Bertina Engelbrecht and Vikesh Ramsunder, management and our people at head office, stores and distribution centres across the country.

Thank you to our customers who continue to make us their first choice health and beauty retailer, and we look forward to their continued support over the next year as Clicks celebrates the 50th anniversary of its founding.

David Kneale

Chief executive officer

Downloads

Downloads

Shareholder Information

Shareholder Information