Some things in life is just better viewed on a big screen Please open this report on a tablet in landscape mode or bigger screen.

Some things in life is just better viewed on a big screen Please open this report on a tablet in landscape mode or bigger screen.

Vikesh Ramsunder, Chief operating officer

Clicks delivered another resilient trading performance in the weak consumer economy, gaining market share in all key product categories. Sales increased by 13.5% driven mainly by volume growth through effective value promotions and price competitiveness.

The chain was rated as the country’s leading health and beauty retailer for the seventh consecutive year in The Times Sowetan Retail Awards 2016, delivering on its strategy of being the customers’ first choice health and beauty retailer. Click here for detail on the Clicks strategy and business model.

Clicks has continued to demonstrate its commitment to customer service, developing management potential and building capacity for the pharmacy profession. This included creating 1 200 new jobs to enhance service, introducing a future store manager training programme as well as investing in bursaries for pharmacy students, providing pharmacy internships and training pharmacy assistants. Refer to the chief executive’s report for detail on these initiatives.

| Health and beauty sales* | % increase | % contribution to total sales |

|---|---|---|

* Includes Clicks, The Body Shop, GNC and Claire’s. |

||

| Pharmacy | 14.2 | 27.3 |

| Front shop health | 14.9 | 23.1 |

| Beauty and personal care | 13.3 | 33.1 |

| General merchandise | 10.8 | 16.5 |

| Total turnover | 13.5 | 100.0 |

Retail pharmacy market share increased to 19.6% (2015: 18.7%) as pharmacy sales grew by 14.2%.

Generic medicines continued to grow faster as more patients are being switched to these lower priced alternatives, with sales increasing by 18.6% and accounting for 47.7% (2015: 45.4%) of pharmacy sales. Over-the-counter medicines, which do not require a prescription, grew by 18.1%.

Front shop health showed strong sales growth of 14.9%. All of the key sub-categories performed well, including medicines which grew by 13.1%, supplements by 10.6% and first aid and diagnostics by 15.4%.

Baby merchandise continues to be the fastest growing category in Clicks, with sales increasing by 19.7% and market share growing to 12.1%.

Growth of 13.3% in beauty and personal care is attributable to effective promotions, product innovation and wider ranges in more stores. The skincare sub-category showed the strongest growth at 18.1% while fragrance benefited from extended ranges and increased sales by 16.5%. Haircare sales grew by 7.5% after relatively muted growth in recent years, with ethnic haircare up 13.7%.

General merchandise grew sales by 10.8%. In the core product categories, confectionery sales grew by 10.9% and electrical by 12.0%, with the market share of small household appliances increasing to 20.0%.

Private label and exclusive brands increase the appeal of the Clicks brand, offer differentiated ranges at competitive prices and are also margin enhancing. Sales of private label products increased to 21.0% (2015: 19.8%) of total sales in Clicks, with front shop sales at 27.0% (2015: 25.7%).

The best-selling ranges of the group’s exclusive health and beauty franchise brands, The Body Shop, GNC and Claire’s, further differentiate the Clicks offer. The Body Shop has a presence in 88 Clicks stores, GNC in 261 stores and Claire’s in 123 Clicks stores. Clicks is also the exclusive retail stockist of the Sorbet product range and this partnership was strengthened during the year when Clicks Group acquired a 25% stake in Sorbet Brands (for further detail refer to the chief executive’s report).

Clicks ClubCard has been part of the chain’s DNA since its launch two decades ago. Following the successful relaunch of ClubCard in 2015 the loyalty programme has attracted over one million new members, bringing total membership to 6.2 million. The relaunch has enabled cashback rewards to be loaded directly onto customers’ cards to increase convenience and modernise the programme, with over R300 million returned to customers in cashback benefits in the past year.

ClubCard members accounted for 77% of sales in Clicks and the average basket value of ClubCard members remains double that of non-ClubCard members.

Clicks continues to expand its store footprint to increase customer convenience. A net 25 new stores were opened to increase the brand’s footprint to 511 at year-end. This includes 26 stores in neighbouring Namibia, Swaziland, Botswana and Lesotho. A further 45 stores across the chain were extended or refurbished to ensure the stores are modern and appealing to customers.

| Market share (%) | 2016 | 2015 |

|---|---|---|

| *IMS. | ||

| **AC Nielsen (comparatives restated). | ||

| ***GfK (comparative restated). | ||

| Health | ||

| Retail pharmacy* | 19.6 | 18.7 |

| Front shop health** | 29.3 | 29.2 |

| Baby** | 12.1 | 11.2 |

| Beauty and personal care | ||

| Skincare** | 27.5 | 26.8 |

| Haircare** | 25.7 | 25.4 |

| General merchandise | ||

| Small household appliances*** | 20.0 | 19.2 |

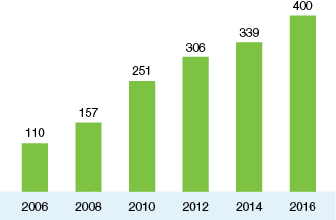

Clicks is the largest retail pharmacy chain with 400 in-store pharmacies, with a net 39 opened in the past year. Primary care clinics in pharmacies are an integral part of the healthcare offering to customers and a driver of pharmacy foot traffic. The number of clinics was increased by 38 to 195.

Clicks launched its online store late in the financial year, enabling customers to buy 15 000 products at www.clicks.co.za, with a “click and collect” facility in all stores in South Africa. The online store increases customer convenience and in the near term is expected to generate sales similar to a small Clicks store.

Clicks will continue to focus on offering good value through appealing promotions and differentiated product ranges.

Private label together with exclusive and franchise brands are targeted to contribute 25% of sales in the medium term. The presence of all three franchise brands will be expanded to additional Clicks stores in the year ahead. The private label generic medicine range will be extended by a further 32 products.

ClubCard membership is targeted to increase to 6.5 million.

Clicks will sustain store growth by opening 20 to 25 new stores in 2017, with the ultimate goal of reaching 800 Clicks stores in South Africa. A further 30 to 35 new pharmacies will be opened, while the goal remains to incorporate a pharmacy into every Clicks store. A further 10 clinics will be opened.

Vikesh Ramsunder

Vikesh Ramsunder

| Plans and targets for 2016 | Achieved in 2016 | Plans and targets for 2017 |

|---|---|---|

| Developing a competitive and differentiated front shop product offer | ||

| Increase front shop private label and exclusive brand sales to 26% | Front shop private label and exclusive sales 27.0% (2015: 25.7%) of total sales | Increase front shop private label and exclusive brand sales to 28.0% |

| Expand presence of franchise brands in Clicks | Franchise brands in Clicks stores

|

Expand presence of franchise brands in Clicks

|

| Creating a great customer experience in pharmacies | ||

| Expand private label scheduled generic medicines range | 100 private label medicines (2015: 76) | Expand private label scheduled generic medicines range by 32 products |

| Grow repeat prescription service to 40% of repeat scripts | 41.2% of scripts now on repeat prescription service | Grow repeat prescription service to 50% of repeat scripts |

| Expand clinic services and open 23 new clinics | Net 38 clinics opened 195 clinics at year-end |

Expand clinic services and open 10 new clinics |

| Growing the retail footprint | ||

| Open 20 to 25 new Clicks stores | Net 25 stores opened (2015: 22) | Open 20 to 25 new Clicks stores |

| 50 stores to be expanded/refurbished | 511 stores at year-end (2015: 486) 45 stores expanded/refurbished (2015: 38) |

60 stores to be expanded/refurbished |

| Open 25 to 35 new pharmacies | Net 39 pharmacies opened (2015: 22) 400 pharmacies at year-end (2015: 361) |

Open 30 to 35 new pharmacies |

| Driving customer loyalty through ClubCard | ||

| Increase membership to 5.5 million | 6.2 million members (2015: 5.0 million) | Increase membership to 6.5 million |

| Grow Baby Club to 250 000 members | 311 000 Baby Club members | Grow Baby Club to 400 000 members |

| Grow Seniors Club to 650 000 members | 752 000 Seniors Club members | Grow Seniors Club to 800 000 members |

| Maintaining a motivated and skilled work force | ||

| 200 pharmacy assistants to be enrolled | 283 pharmacy assistants enrolled | 300 pharmacy assistants to be enrolled |

| 100 pharmacy bursary students | 106 pharmacy bursary students | 100 pharmacy bursary students |

| 50 internships | 83 pharmacy internships | 90 internships |

Joined the group in 1993

Previously managing director of UPD and prior to that was head of logistics at Clicks

Extensive retail, distribution and logistics experience

Joined the group in 2010

Formerly group head of IT and before that worked for the Ikano Group in Europe

Over 15 years’ international retail and FMCG experience in large supply chain and IT organisations

Joined the group in 2006

Previously head of group finance and head of internal audit

Prior to this held various financial positions with Alliance Boots in the UK

Joined the group in 2011

Previously commercial head at UPD

Pharmaceutical manufacturing, hospitals, pharmacy and commercial healthcare experience

Joined the group in 2015

Previously chief sales and operations officer at Nashua

Extensive experience in retail operations, supply chain, brand development and management consulting

Joined the group in 2015

Previously HR director at Chevron SA

Experience in human resources management, employee relations, organisation development, transformation and talent management

Joined the group in 2013

Previously European commercial director for a leading global travel retail operator

Extensive international retail experience, including Tesco Stores in the UK

Joined the group in 2016

Previously IT director at Massbuild, a division of Massmart

Experienced in IT systems implementations and management in retail and FMCG