Some things in life is just better viewed on a big screen Please open this report on a tablet in landscape mode or bigger screen.

Some things in life is just better viewed on a big screen Please open this report on a tablet in landscape mode or bigger screen.

The directors recognise that good governance can create shareholder value by enhancing long-term equity performance. While the board is unwavering in its adherence with legislation, regulations and codes, the group’s commitment to good governance goes beyond compliance.

The directors believe that governance can contribute to value creation through:

The group’s robust governance and compliance framework is based on the principles of accountability, transparency, ethical management and fairness, and a philosophy of sound governance is entrenched across the business.

This abridged governance report is supplemented by the group’s corporate governance report which provides detailed disclosures on the functioning of the board and its committees, risk management, corporate accountability and compliance.

The directors are accountable for the sustainability of the business and are responsible to the shareholders of the company who elect them. The role of the board includes approving strategic plans, monitoring operational performance, ensuring effective risk management and internal controls, and monitoring legislative, regulatory and governance compliance. The board is also required to approve significant accounting policies and the annual financial statements, monitor transformation and empowerment, manage director selection and appointment, and ensure the group has effective remuneration policies and practices. Certain of these functions are delegated to board committees. The board charter details the authority, responsibility, composition and functioning of the board.

The board continued to operate within its mandate and conducted its affairs as outlined in the board charter. In addition the board addressed the following issues:

The board consists of nine directors, with three salaried executive directors and six independent non-executive directors.

| Director | Status | Year appointed |

|---|---|---|

| David Nurek | Independent non-executive director | 1997 |

| Fatima Abrahams | Independent non-executive director | 2008 |

| John Bester | Independent non-executive director | 2008 |

| Bertina Engelbrecht | Executive director | 2008 |

| Michael Fleming | Executive director | 2011 |

| Fatima Jakoet | Independent non-executive director | 2008 |

| David Kneale | Executive director | 2006 |

| Nkaki Matlala | Independent non-executive director | 2010 |

| Martin Rosen | Independent non-executive director | 2006 |

The executive directors have an average of 7.6 years’ service on the board and the non-executive directors an average of 9.8 years.

Brief credentials on the directors and their expertise and experience are included here.

All six non-executive directors are classified as being independent in terms of King lll. This was confirmed in the 2016 internal evaluation of the status of the non-executive directors which included an assessment of the chairman, David Nurek, who has served as a non-executive director for 19 years.

There are no shareholder interests represented on the board, further confirming the independence of the board.

The diversity of the directors in terms of gender, race and their professional backgrounds encourages constructive debate and ensures that the board considers the needs of a wide range of stakeholder interests.

Regular election of directors ensures that shareholders are able to exercise their right to appoint directors they believe will add value to the company. One-third of the non-executive directors are required to retire at the AGM each year. Executive directors retire on the third-year anniversary of their appointment or most recent re-election to the board.

Good governance is maintained through the annual evaluation undertaken by the directors of the performance of the board, the chairman, the chief executive officer, individual directors and all board committees.

The 2016 evaluation indicated that the board and its committees have discharged their responsibilities adequately. The directors believe the board contributes to value creation in the company, is well balanced and has the relevant knowledge to make a meaningful contribution to the group’s affairs.

The roles of the chairman and chief executive are separate and clearly defined, ensuring that no director has unrestricted decision-making powers. The chairman, David Nurek, leads the board and the chief executive, David Kneale, is responsible for the executive management of the group.

The board and executive management team work closely in determining the strategic objectives of the group. Authority has been delegated by the board to the chief executive and the group executive committee for the implementation of the strategy and the ongoing management of the business.

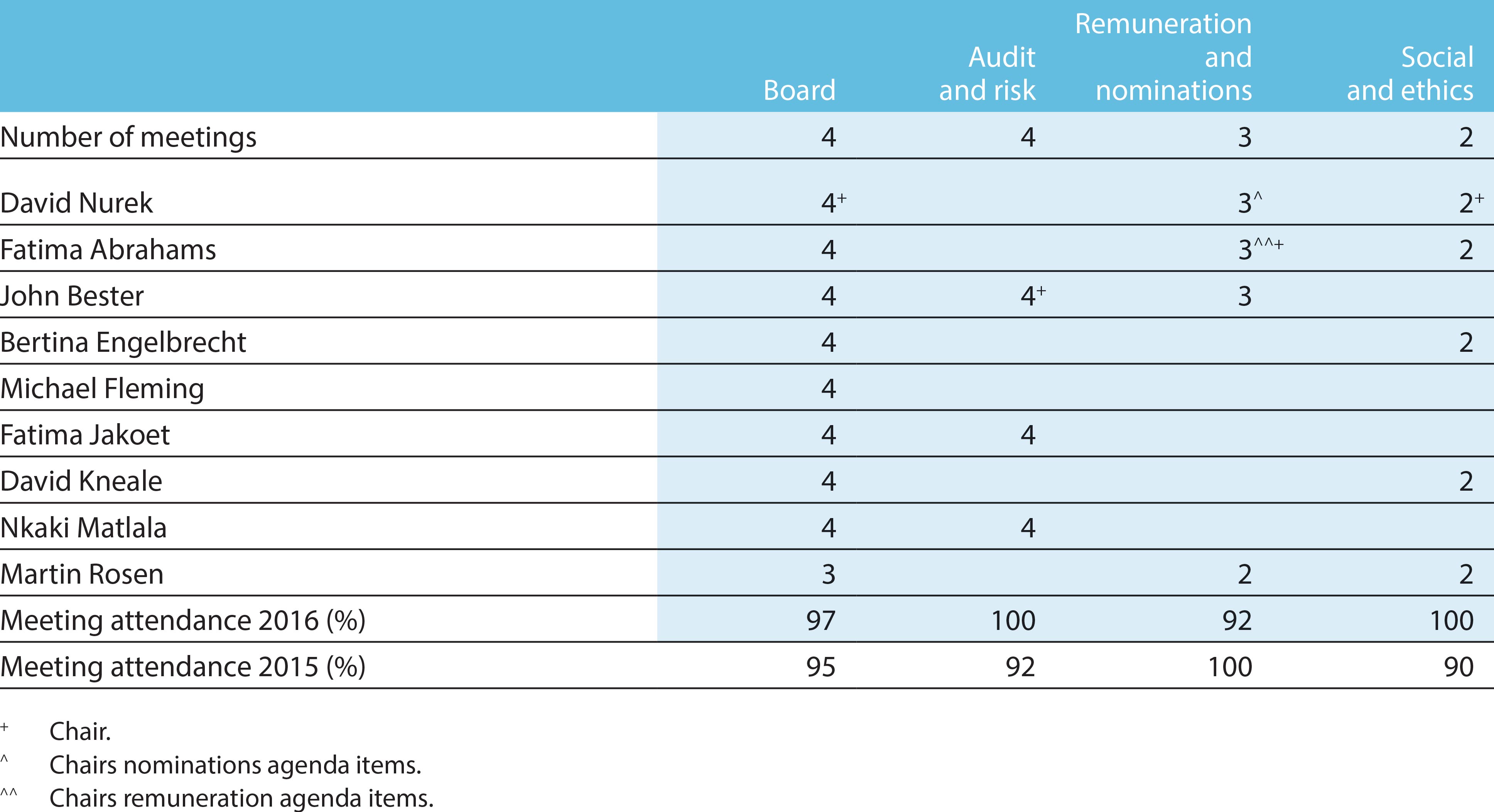

Specialised governance functions are delegated to three committees to assist the board in meeting its oversight responsibilities. All board committees are chaired by independent non-executive directors and the composition of the committees conforms to the requirements of King lll. Detailed disclosure on the roles and functioning of the committees is included in the corporate governance report.

The group voluntarily applies the principles of the King Code of Governance Principles 2009 (King III) and the board remains satisfied with the manner in which the group has applied the recommendations of the code. Governance processes are regularly reviewed to align with legislative and regulatory changes and to reflect changes in the business to ensure processes remain relevant.

The group strives to achieve the highest ethical standards of business practice. A set of values and a behavioural code of conduct require staff to display integrity, mutual respect and openness, and affords them the right and obligation to challenge others who are not adhering to these values. Policies have been implemented which require all employees to adhere to ethical business practices in their relationships with colleagues, suppliers, intermediaries, shareholders and investors. These policies also set stringent standards relating to the acceptance of gifts from third parties and declarations of potential conflicts of interests.

Clicks Group does not engage in practices that could limit competition or that could adversely impact on customers. Robust risk management and supervisory oversight processes are in place to ensure adherence to competition law and regulations. The group occupies a market-leading position in healthcare retailing and supply in South Africa and guards the confidentiality of intellectual property, customer and supplier data, business processes and methodologies. Effective governance processes have ensured that the group has not been sanctioned for anti-competitive practices or for non-compliance with the Competition Act during the year.

The governance landscape in South Africa will be further enhanced with the introduction of the King IV Code of Corporate Principles which will be effective from 2017. There have been significant corporate governance and regulatory developments, both locally and internationally, since the introduction of King III in 2009 which are being incorporated into the new code. The directors welcome governance codes which facilitate value creation without adding burdensome compliance requirements on companies.