Business review: Clicks

Clicks and UPD both occupy market-leading positions in South Africa and their operating margins rank in the upper quartile of global drugstores and pharmaceutical wholesalers.

View Clicks video

Clicks delivered another resilient performance in the increasingly constrained consumer spending environment. The strength of the Clicks brand and its loyal customer base contributed to health and beauty sales increasing by 11.7%, with volume growth of 5.1% in same stores, as Clicks gained market share in all product categories.

Clicks was again rated as the country’s leading health and beauty retailer and pharmacy chain in the Sunday Times/ Sowetan Shopper Survey for 2018.

Sales performance

Clicks has been synonymous with value retailing since its founding 50 years ago and value is particularly relevant to cash-strapped customers in the current challenging economic climate. Clicks continues to invest to offer great everyday pricing and this is supported by an active promotions strategy, centred around the brand’s well-known 3 for 2 offers. Promotional sales increased by 14.7% and accounted for 35.0% of turnover in Clicks.

Pharmacy sales grew by 13.2% and comprised 30.8% of turnover. Growth was impacted by the poor winter season for colds and flu which depressed medicine sales as well as the low SEP increase relative to the previous year. Clicks continued to grow ahead of the market and increased its share of the retail pharmacy market from 22.1% to 23.3%.

“Clicks has been synonymous with value retailing since its founding 50 years ago”

Front shop health was the fastest-growing category with sales increasing by 14.1%, supported by the robust performances of GNC (up 19.5%), first aid (up 21.5%) and baby (up 19.6%). The baby sub-category is strategically important in attracting new customers and grew market share from 13.7% to 15.1%.

Beauty and personal care sales grew by 7.6%. Owing to the limited product innovation in these categories, promotional activity was key to driving volume growth. The best-performing sub-categories were ethnic haircare, gifting and The Body Shop range which has been extended into a further 48 Clicks stores.

| Health and beauty sales* |

% increase |

% contribution to sales |

| Pharmacy |

13.2 |

30.8 |

| Front shop health |

14.1 |

23.3 |

| Beauty and personal care |

7.6 |

30.2 |

| General merchandise |

13.1 |

15.7 |

| Total turnover |

11.7 |

100.0 |

General merchandise, which has the most discretionary product offering, grew sales by 13.1%. Growth was driven by buoyant Christmas sales, a pleasing promotional performance from convenience categories such as paperware and beverages, and good growth in the healthy snacking category. Clicks remains the leader in sales of small electrical appliances with a market share of 17.9%.

| Market share (%) |

2018 |

2017 |

| Health |

|

|

| Retail pharmacy* |

23.3 |

22.1 |

| Front shop health** |

30.8 |

30.0 |

| Baby** |

15.1 |

13.7 |

| Beauty and personal care |

|

|

| Skincare** |

36.1 |

36.0 |

| Haircare** |

28.2 |

26.7 |

| General merchandise |

|

|

| Small electrical appliances*** |

17.9 |

17.4 |

Extending convenience

Clicks opened a record 41 new stores and increased the brand’s footprint to 663 stores at year-end. The store opening programme was accelerated beyond the targeted 25 to 30 stores owing to opportunities arising for new space in existing shopping centres.

“The Clicks online store generated sales equivalent to a medium-sized Clicks store”

The Clicks footprint includes 33 stores in neighbouring Namibia (21 stores), Swaziland (four stores), Botswana (seven stores) and Lesotho (one store).

During the year 55 stores across the chain were extended or refurbished to ensure the stores remain modern and appealing to customers.

Clicks is South Africa’s largest retail pharmacy chain and extended its network to 510 with the opening of 37 in-store pharmacies. The number of clinics was increased from 195 to 203.

Clicks was once again ranked first in the pharmacy category in the annual Ask Afrika Orange Index service excellence survey.

The Clicks online store further enhances customer convenience, offering the full product range available in large Clicks stores. The offer is being extended to include online only ranges, with prestige beauty being the first of these ranges. Customers can select home delivery or the “click and collect” in store service, which is also driving incremental spending in stores. The online store has performed well in the past year and generated sales equivalent to a medium-sized Clicks store.

“ClubCard attracted over 800 000 new members, bringing total active membership to 7.8 million”

Engaging customers

ClubCard is integral to the Clicks digital customer engagement strategy which aims to complement the store experience and enables Clicks to better understand and engage with customers, and influence the behaviour of shoppers.

ClubCard is South Africa’s most popular loyalty programme and attracted over 800 000 new members in the past year, bringing total active membership to 7.8 million. ClubCard members accounted for 77.2% of sales in Clicks and R442 million was returned to customers in cashback.

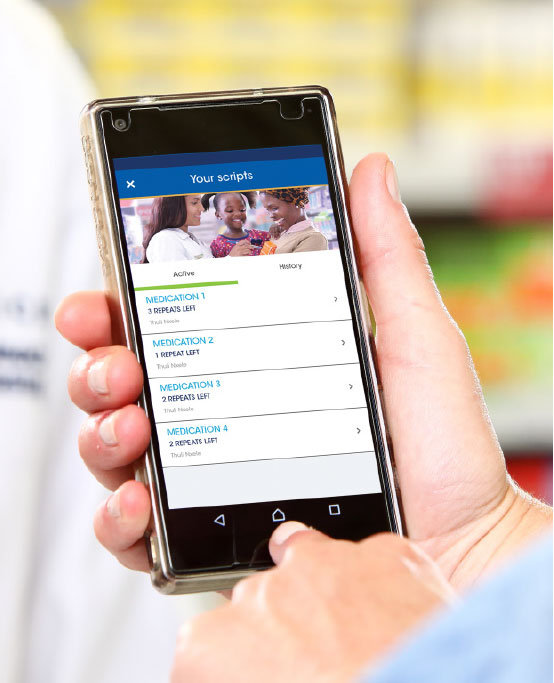

Digital technology provides new ways to engage with customers, including the Clicks mobile app which incorporates a virtual ClubCard, eliminating the need for customers to use the traditional plastic card. The app also allows customers to submit scripts and order repeat medication. Customer response has been most encouraging and the mobile app has been downloaded by over 250 000 customers.

Differentiated product offer

Private label and exclusive brands offer differentiated ranges at competitive prices while increasing the appeal of the Clicks brand and enhancing margin.

International franchise brands, The Body Shop, GNC and Claire’s, further differentiate the Clicks offer. The Body Shop has a presence in 170 Clicks stores, GNC in 454 stores and Claire’s in 168 Clicks stores. Clicks is also the exclusive retail stockist of the Sorbet product range.

Innovation is a key driver of private label sales and over 700 new products were launched during the year. This included the successful launch of Sorbet Cosmetics, a range of over 320 products for faces, lips, eyes and nails, initially sold in 123 Clicks stores and 40 Sorbet salons.

Sales of private label products accounted for 22% of total sales in Clicks, with front shop sales at 28.2% and pharmacy 5.6%.

Improving customer care

Clicks continues to invest in improving customer care to enhance the in-store experience and ensure customers are served by friendly and knowledgeable staff. In the past year R102 million was invested in staff training and development across store managers, pharmacists, pharmacy assistants and front shop staff, including beauty advisers.

“Clicks has invested over R27 million in pharmacy bursaries in the past six years”

As the largest employer of pharmacy staff in the private sector with over 2 800 pharmacy and clinic professionals, Clicks is actively building capacity through the Pharmacy Healthcare Academy and providing financial support to address the critical shortage of pharmacists.

Clicks awarded 83 bursaries to pharmacy students in 2018 and has invested over R27 million in bursaries in the past six years. During the year 359 pharmacy assistants were enrolled and 70 pharmacy internships awarded.

The store operations learnership programme attracted 122 trainee managers while 20 graduates completed the retail graduate development programme.

Outlook for 2019

Clicks plans to open 25 to 30 new stores and 30 to 35 pharmacies as the chain moves towards its long-term goal of expanding its South African store footprint to 900, with a pharmacy in each store. A further 55 stores will be refurbished.

Private label, exclusive and franchise brands are planned to contribute 29.5% of front shop sales in the new year. The presence of The Body Shop, GNC and Claire’s will be expanded to additional Clicks stores in the year ahead. The distribution of the Sorbet cosmetics brand will be extended to a further 60 stores. The private label generic medicine range will be extended by 34 products.

ClubCard membership is targeted to grow to 8.0 million while technology and data analytics will be applied to personalise engagement with customers.

The Clicks distribution centre in Centurion, Gauteng, is being expanded by 20 900 m2 to support the increasing scale of the Clicks chain. The project commenced in 2017 and is being undertaken at a cost of R230 million. The first phase of the construction has been completed and the second phase is scheduled to be completed by September 2019.

Vikesh Ramsunder

Chief operating officer

Vikesh Ramsunder

Chief operating officer

Vikesh (47) joined the group in 1993 and was appointed as chief operating officer of the Clicks brand in 2015. He was previously managing director of UPD, the group’s pharmaceutical wholesaler, from 2010 and was instrumental in driving UPD’s integrated pharmaceutical wholesale and distribution strategy. Prior to this he was head of logistics at Clicks for two years, and served in store, general management and distribution centre management positions across the group. He holds B Com and MBL degrees. Vikesh has been promoted to chief executive officer of the Clicks Group from 1 January 2019.

Performance against objectives in 2018 and plans for 2019

Deliver a competitive and differentiated front shop product offer

Plans and targets for 2018

Achieved in 2018

Plans and targets for 2019

Increase front shop private label and exclusive brand sales to 29.0%

Front shop private label and exclusive sales 28.2% of total sales

Increase front shop private label and exclusive brand sales to 29.0%

Expand presence of franchise brands in Clicks

- The Body Shop: 150 stores

- GNC: 390 stores

- Claire’s: 150 stores

Franchise brands in Clicks stores

- The Body Shop: 170 stores

- GNC: 454 stores

- Claire’s: 168 stores

Create a great customer experience

Plans and targets for 2018

Achieved in 2018

Plans and targets for 2019

Expand private label scheduled generic medicines range by 30 products

120 private label medicines (2017: 100)

Expand private label scheduled generic medicines range by 34 products

Increase repeat prescription service to 50% of repeat scripts

44% of scripts now on repeat prescription service

Increase repeat prescription service to 50% of repeat scripts

200 – 210 clinics at

year-end

Grow the retail footprint

Plans and targets for 2018

Achieved in 2018

Plans and targets for 2019

Open 25 to 30 new Clicks stores

Net 41 stores opened 663 stores at year-end

Open 25 to 30 new Clicks stores

55 stores to be expanded/refurbished

55 stores expanded/refurbished

55 stores to be expanded/refurbished

Open 30 to 35 new pharmacies

Net 37 pharmacies opened

510 pharmacies at year-end

Open 30 to 35 new pharmacies

Insource digital capability and improve personalisation

Digital marketing capability insourced

Improve personalisation capability

Drive customer loyalty through ClubCard

Plans and targets for 2018

Achieved in 2018

Plans and targets for 2019

Increase membership to 7.5 million

Increase membership to 8.0 million

Grow Baby Club to 520 000 members

445 000 Baby Club members

Grow Baby Club to 500 000 members

Grow Seniors Club to 900 000 members

925 000 Seniors Club members

Grow Seniors Club to 1.0 million members

Enrol 100 000 customers to virtual ClubCard

240 000 customers enrolled to virtual ClubCard

Enrol 500 000 customers to virtual ClubCard

Ensure supply chain excellence

Plans and targets for 2018

Achieved in 2018

Plans and targets for 2019

Complete Centurion distribution centre expansion

Phase 1 completed, adding 14 200 m2

Phase 2 to be completed September 2019, adding 6 700 m2

Maintain a motivated and skilled workforce

Plans and targets for 2018

Achieved in 2018

Plans and targets for 2019

300 pharmacy assistants to be enrolled

359 pharmacy assistants enrolled

300 pharmacy assistants to be enrolled

100 pharmacy bursary students

94 pharmacy bursary students

100 pharmacy bursary students

20 graduates to be enrolled on graduate development programme

20 graduates enrolled on graduate development programme

20 graduates to be enrolled on graduate development programme

Downloads

Downloads

Shareholder Information

Shareholder Information