Operational Review

“UPD now has market-leading positions in both the pharmaceutical wholesale and bulk distribution markets.”

Vikash Singh, Managing director

Vikash (41) was appointed as managing director of UPD in April 2015. He is a seasoned executive with extensive experience in Clicks and UPD. After joining the group in 2006, he served in finance and risk management roles in distribution and logistics in the Clicks chain. Vikash moved to UPD in 2010 and was head of operations and distribution prior to his promotion to managing director.

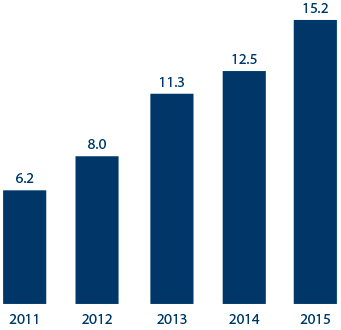

UPD total managed turnover

R’billion

UPD continued to entrench its integrated pharmaceutical wholesale and distribution strategy and increased reported turnover by 21.6% as the business benefited from the growth in its preferred supply chain partner distribution contracts.

Total managed turnover, combining wholesale turnover with the turnover managed on behalf of distribution agency clients, increased by R2.7 billion to R15.2 billion. Total managed turnover has grown strongly in recent years, delivering a four-year compound annual growth of 25.1%.

This growth highlights the success of the strategy of developing the distribution business alongside UPD’s traditional fine wholesaling business. UPD now has market-leading positions in both the pharmaceutical wholesale and bulk distribution markets.

UPD continues to face ongoing margin pressure from the faster growth in lower priced generics, which now account for 45.7% (2014: 40.5%) of medicines. The increasing penetration in generics is expected to continue and UPD is therefore focused on constantly improving efficiencies.

Inflation averaged 4.2% for the year despite an increase of a maximum of 7.5% being allowed in the regulated single exit price (SEP) of medicines for 2015.

UPD’s financial performance is covered in the chief financial officer’s report.

Fine wholesale

|

Fine wholesale turnover |

% |

% |

|

Clicks |

10.7 |

41.4 |

|

Hospitals |

7.5 |

31.9 |

|

Independent pharmacy |

2.3 |

19.0 |

|

Other channels |

3.9 |

7.7 |

|

Fine wholesale turnover |

7.4 |

100.0 |

Fine wholesale turnover grew by 7.4%. Clicks remains UPD’s largest single customer, with sales to Clicks pharmacies increasing by 10.7% and accounting for 41.4% of fine wholesale turnover. Sales to the private hospital groups, including Life Healthcare, Mediclinic and Netcare, grew by 7.5% and contributed 31.9% of turnover.

Sales to independent pharmacies grew by 2.3%. Despite the contraction in this sector in recent years, UPD still services over 1 300 independent pharmacies which account for 19.0% of turnover.

Product availability, which is core to offering superior range and service to customers, was 95% and UPD maintained on-time deliveries at 98%.

Distribution

Through its distribution business UPD offers local and international, generic and originator pharma manufacturers an efficient and cost-effective supply chain solution.

Distribution turnover increased by 34.6% and now accounts for 51% of UPD’s total business.

The business managed a portfolio of 22 distribution clients at year-end.

Outlook for 2016

In the year ahead UPD aims to increase wholesale market share in line with the growth from its core customers of Clicks pharmacies and the private hospital groups. The planned acceleration in the rate of Clicks pharmacy openings is positive for UPD, with Clicks targeting to open 25 to 35 pharmacies.

UPD is currently building a new distribution centre in Port Elizabeth. On the completion of this facility in mid 2016 UPD will own all five of its distribution centres in South Africa.

The margin pressure from the faster growth in generics will continue and there are no more significant distribution contracts expected to benefit UPD in 2016, which will make it a demanding year for UPD. In this environment UPD will focus on becoming more efficient through improved business processes, quality management and system enhancements.

Vikash Singh

Managing director