Some things in life is just better viewed on a big screen Please open this report on a tablet in landscape mode or bigger screen.

Some things in life is just better viewed on a big screen Please open this report on a tablet in landscape mode or bigger screen.

David Nurek, Independent non-executive chairman

South Africa is in the midst of one of the most challenging times in recent decades, with political uncertainty and instability, civil and social unrest, a deteriorating labour market and unprecedented currency volatility being a feature of the past year.

These factors are all compounding South Africa’s already weak growth prospects, while the threat of a sovereign rating downgrade looms ominously over the country.

Retail spending has come under increasing pressure in this environment, with financially stressed consumers also encountering increasing interest rates, higher food, utility and education costs, and rising health insurance costs. Consumer and business confidence is understandably low.

However, the group has once again shown its resilience in the face of growing economic headwinds and produced another strong performance, particularly from the Clicks chain which has entrenched its leading position in the competitive health and beauty retail sector.

The group’s performance for the year translated into an increase of 14.2% in diluted headline earnings per share to 438.5 cents. Shareholders will receive a total dividend of 272.0 cents per share, 15.7% higher than last year. Dividends have grown at an annual compound rate of 23.4% over the past ten years while the payout ratio has increased from 45% to 59% over the same time.

In the past three years the group has generated a total shareholder return of 134%, driven by our strategy of pursuing organic growth in the South African market.

In March this year the group celebrated its 20th year of listing on the JSE. New Clicks Holdings, as our company was known, listed at a price of R3.70 with a market capitalisation of R915 million. In 2016 the share price reached an all-time high of R130.50, with the market capitalisation exceeding R30 billion.

Since its debut on the stock market in 1996 the group has generated shareholder value of R33 billion.

While the scale of the group has shown phenomenal growth over the past 20 years the business has also changed fundamentally. At the time of listing the group was not yet active in the retail pharmacy or wholesale pharmaceutical markets.

Today Clicks is the country’s leading retail pharmacy chain and UPD is South Africa’s foremost pharmaceutical wholesaler and distributor.

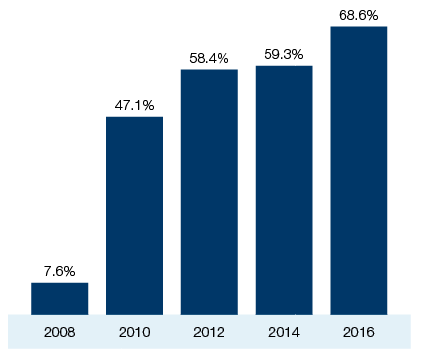

The JSE is one of the most admired exchanges globally and is to be commended for its high corporate and regulatory standards. This has certainly contributed to the Clicks Group attracting extensive foreign investment, with 69% of our shares currently held by offshore fund managers.

The strong organic growth prospects for the core Clicks chain creates a compelling investment case for investors seeking equity exposure to the retail and healthcare sectors in South Africa.

The healthcare markets in which we trade are defensive and growing, with an increasing proportion of the South African population entering private healthcare. Improving living standards, increasing urbanisation and longer life expectancy are all contributing to the growth in the health and beauty products market.

Our business model is resilient, with over 80% of revenue in defensive merchandise categories. Clicks and UPD have market-leading positions and their operating margins rank in the upper quartile of global drugstores and pharmaceutical wholesalers.

Clicks currently has over 500 stores and management has revised the longer-term store goal, confident that the chain can grow to 800 stores in South Africa over the next ten years. Clicks remains committed to its objective of incorporating a pharmacy into every Clicks store and growing its retail pharmacy market share to 30% in the long term.

The investment case is supported by sustained financial and operational performance, a proven capital management strategy which enhances returns to shareholders and the group’s ability to generate strong free cash flows.

As a board we recognise that good governance can create sustainable value and enhance long-term equity performance. It is pleasing to report that the group qualified for inclusion in the recently introduced FTSE/JSE Responsible Investment Index. As part of the evaluation for the index the group’s environmental, social and governance (ESG) standards were independently evaluated, and we attained 100% for the governance pillar. This authoritative endorsement of the group’s governance standards should provide assurance to our shareholders and potential investors.

Our board is stable with an appropriate balance of skills and expertise. The diversity of the directors in terms of gender, race and their professional backgrounds encourages constructive debate and ensures that the board considers the needs of our wide range of stakeholders and interest groups. The independence of the board is reviewed annually and all six of the non-executive directors are classified as independent.

Dr Nkaki Matlala, who has served as an independent non-executive director since 2010, will be retiring from the board at the annual general meeting in January 2017. We thank Dr Matlala for his contribution over the past six years, particularly in his specialist field of healthcare, and wish him well.

The governance landscape in South Africa will be enhanced with the introduction of the King IV Code of Corporate Principles which will be effective from 2017. There have been significant corporate governance and regulatory developments, both locally and internationally, since the introduction of King III in 2009 which are being incorporated into the new code. The directors welcome governance codes which facilitate value creation without adding burdensome compliance requirements on companies.

The strong financial and operational performance over the past year is a credit to the group’s leadership and I thank David Kneale and his executive team for ensuring that the business maintains its market-leading position. I also wish to acknowledge the role played by our 14 100 employees in delivering these results and for their commitment to meeting the needs of our customers.

My fellow non-executive directors have continued to provide valuable insight and oversight, and I thank them for their support.

Thank you to our customers, shareholders and investment analysts, suppliers and industry regulators for your continued support and engagement.