Some things in life is just better viewed on a big screen Please open this report on a tablet in landscape mode or bigger screen.

Some things in life is just better viewed on a big screen Please open this report on a tablet in landscape mode or bigger screen.

MATERIAL ISSUES have been identified which could impact positively or negatively on the group’s ability to create and sustain value. These material issues are reviewed annually by the board and management where all relevant internal, industry and macroeconomic factors are evaluated. The needs, expectations and concerns of the stakeholder groups that are most likely to influence the group’s ability to create sustainable value, notably shareholders, customers, suppliers and staff, are central to determining the material issues. Following the board’s review for the 2017 financial year, the material issues are unchanged from 2016.

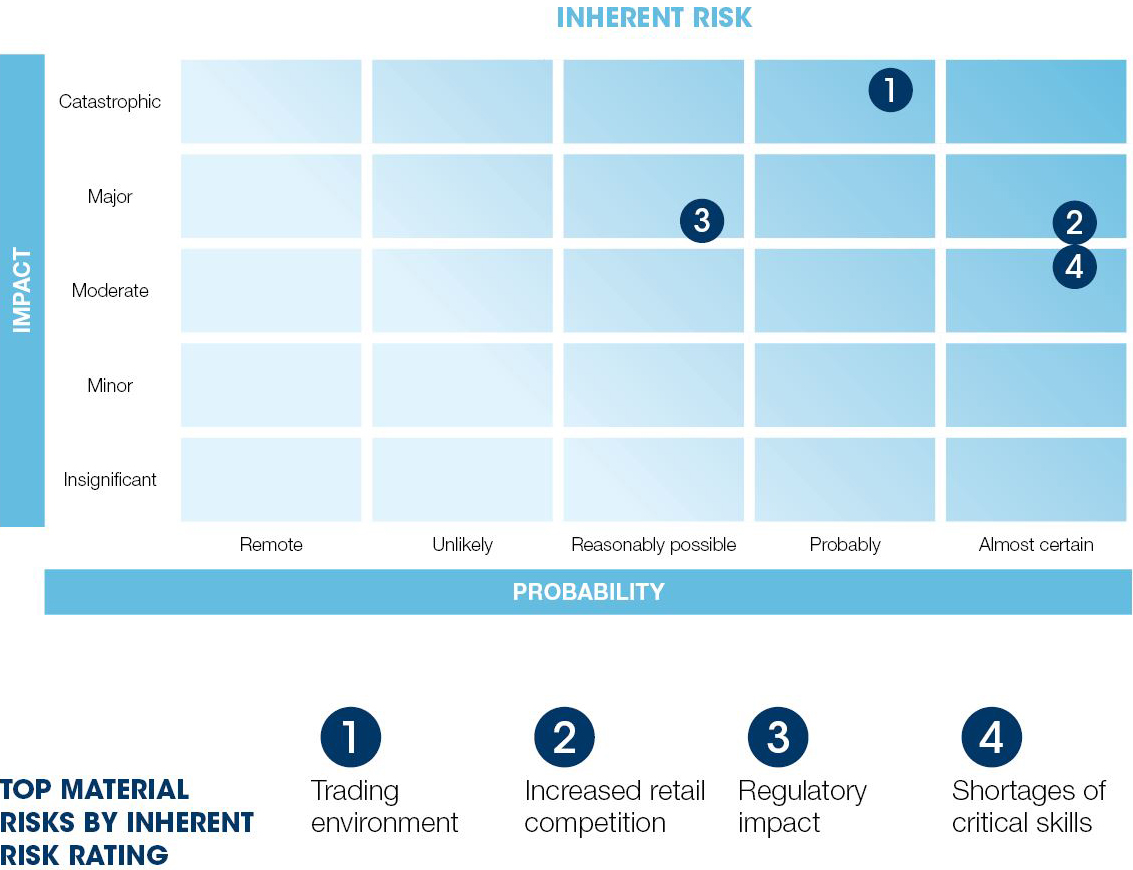

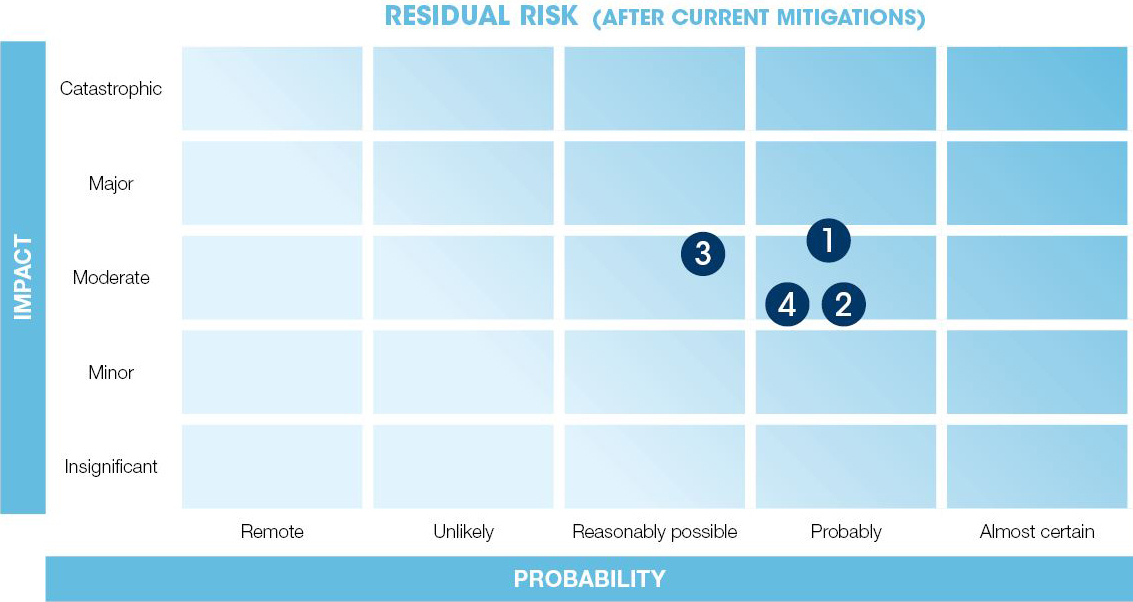

RISKS relating to each material issue are based on the major risks on the group’s register. The accompanying graphic indicates the levels of risk before (inherent risk) and after (residual risk) mitigation plans have been implemented.

OPPORTUNITIES are presented for each material issue to indicate how the group is using its competitive advantage to manage the impacts of the material issues on value creation.

South Africa’s retail trading environment, which has been severely constrained in recent years, is coming under increasing pressure owing to the deteriorating economic conditions in the country and greater demands on consumer disposable income. Social unrest, political uncertainty and the weakening labour market are limiting economic growth and this is being compounded by the volatile and depreciating currency. Consumer confidence is at lower levels than recorded during the global financial crisis of 2008/2009 and consumers are facing higher health insurance costs, rising food, utility and general living costs, as well as increasing debt servicing costs owing to rising interest rates.

As a health and beauty retailer Clicks faces competition on several fronts, including corporate and independent pharmacy, national food retailers, general merchandise chains, and specialist health and wellness stores. The level of competition is being intensified by the sustained expansion of national food chains and corporate pharmacy, and new entrants into the local market. In the current constrained consumer spending environment retailers are increasingly price competitive and adopting aggressive promotional strategies to attract cash-strapped consumers and protect sales volumes. In this climate Clicks Group is one of the few listed retailers to have increased sales volumes while maintaining its operating margin.

Healthcare markets are highly regulated across the world and approximately 50% of the group’s turnover is in regulated pharmaceutical products. The group supports regulation that advances the government’s healthcare agenda of making medicines more affordable and more accessible to all South Africans. However, the current regulatory regime imposes obstacles which inhibit access to affordable healthcare and also limits customer choice. Management actively engages with the Department of Health on an ongoing basis on current and proposed regulation and legislation which impacts the business and its customers.

Attracting and retaining talent is critical to the group’s sustained performance in an industry where scarce retail and healthcare skills are in high demand locally and internationally. This is addressed through the group’s ongoing investment in its people through competitive remuneration packages and incentive schemes, career path planning, creating a stimulating working environment, transformation and empowerment, with R244 million invested in training and skills development over the past five years. A broad-based employee share ownership plan (ESOP) has enabled staff to share in the long-term growth and success of the business, and at the same time retain critical skills in the group. As the largest employer of pharmacy staff in the private sector in South Africa the group is actively building capacity to address the critical shortage of pharmacists which is a challenge the world over.